Please Try Again or Contact Us to Complete Your Order Verizon

Verizon Communications Inc. VZ recently collaborated with Sawatch Labs to help fleet operators seamlessly drift to electric vehicles (EV). This is likely to optimize the operating costs of vehicles with key inputs from the analytics firm while significantly contributing to the environs-friendly fashion of transportation.

EVs are likely to course a considerable part of the vehicle fleet in the near hereafter, bringing to the fore the need for effective EV fleet direction. This is where Sawatch Labs pitches in with its complex analytics models leveraging car learning technology to identify opportunities within the fleet for actionable insights. Its data-driven analysis helps unlock the fleet's potential past optimizing decisions ranging from the correct fleet size to accurate procurement and assignment.

Verizon Connect Reveal, the fleet management software platform from the carrier, offers customizable GPS fleet management software to effectively track vehicle locations and commuter behavior similar speeding, idling and harsh driving to improve fleet operations. This, in plow, helps reduce costs for vehicle maintenance and fuel consumption while improving dispatch, routing and visibility past proactively allocating resources for optimum utilization.

Fleet operators had historically utilized 3G devices to track vehicles that often failed to provide precise data in remote locations that lacked extensive network coverage. By migrating to 4G and deject networks and utilizing Sawatch Labs analytics, fleet operators will be able to identify authentic location information for faster routing facilities by deploying the closest vehicle to customers. With the Verizon Connect Reveal app, which is exclusively available in the 4G network, customers will do good from a new Loftier-Fidelity Tracking feature. This nugget tracking software offers a three-fold spring in the frequency of real-time vehicle location updates on the Live Map, thereby providing college visibility of project-disquisitional equipment.

The strategic partnership between Verizon and Sawatch Labs is likely to standardize and optimize applications and assist fleet operators accelerate innovation, reduce risks and improve efficiency levels. Information technology volition likely offer customers the disquisitional data to make smarter, more than cost-effective, long-term investments in their fleets for a assisting business and a safe and make clean surroundings.

With one of the most efficient wireless networks in the United States, Verizon deploys the latest 4G LTE Advanced technologies to evangelize faster peak information speeds and capacity for customers, driven by customer-focused planning, disciplined engineering and constant strategic investment. The company remains focused on making necessary capital expenditures due to the expansion of 5G mmWave in new and existing markets, the densification of the 4G LTE wireless network to cater to huge traffic demands beyond multiple verticals and the continued deployment of the fiber infrastructure.

Verizon's 5G mobility service offers an unparalleled experience that impacts industries every bit diverse every bit public safety, wellness care, retail and sports. The company'south 5G network hinges on three primal drivers to deliver the total potential of next-generation wireless engineering science. These are massive spectrum holdings, particularly in the millimeter-moving ridge bands for faster data transfer, end-to-end deep cobweb resources and the ability to deploy a large number of small cells. In order to expand coverage and improve connectivity, Verizon has acquired 161MHz of mid-band spectrum in the C-Ring sale for a full consideration of $45.5 billion. These airwaves offer significant bandwidth with ameliorate propagation characteristics for optimum coverage in both rural and urban areas.

The visitor is continuing with the aggressive rollout of 5G Ultra Wideband service to aggrandize its coverage beyond the country. It is also offering the best of LTE and 5G Ultrawideband facilities with the launch of On Site 5G — a transformative on-premises, individual 5G network — for business enterprises. This customized solution enables firms hitherto crippled with coverage gaps, lost connectivity, fractured security, data congestion and inconsistent service quality to take a defended capacity with acceptable bandwidth to minimize costly downtime and missed opportunities.

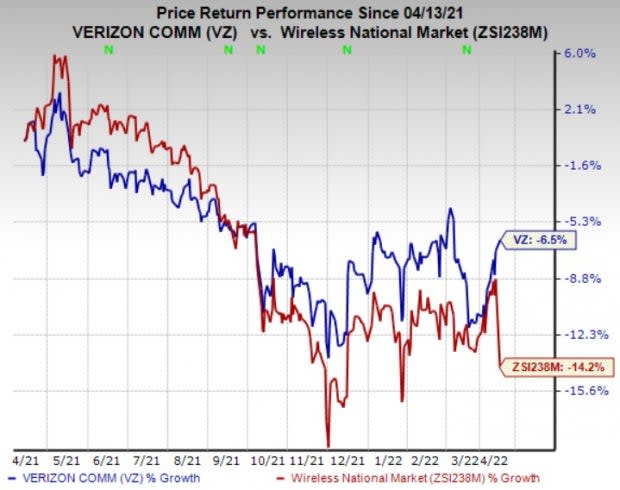

The stock has lost half dozen.5% over the past year compared with the industry'southward decline of xiv.two%. Even so, we remain impressed with the inherent growth potential of this Zacks Rank #iii (Hold) stock. You can see the complete list of today'southward Zacks #1 Rank (Strong Purchase) stocks here.

Prototype Source: Zacks Investment Research

Sierra Wireless, Inc. SWIR, carrying a Zacks Rank #2 (Buy), is a solid pick within the industry in the broader industry classification. Information technology has a long-term earnings growth expectation of 12.five% and delivered an earnings surprise of 58%, on average, in the abaft four quarters.

Over the past year, Sierra Wireless has gained eleven.5%. Earnings estimates for the electric current year for the stock have moved up 68.8% since April 2021. The company continues to launch innovative products for business organisation-critical operations that crave loftier security and optimum 5G performance.

Arista Networks, Inc. ANET, sporting a Zacks Rank #1, is some other solid pick for investors in the broader industry nomenclature. It has a long-term earnings growth expectation of 15.four% and delivered a minor earnings surprise of 7.7%, on average, in the trailing four quarters. Earnings estimates for the current yr have moved up xxx.4% since April 2021, while that for the next twelvemonth is up 41.1%.

Arista benefits from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to assistance customers build their cloud compages and raise their deject feel. Over the past year, Arista has gained 69.half-dozen%.

KVH Industries, Inc. KVHI is a Zacks Rank #ii stock. It delivered an earnings surprise of 20%, on average, in the trailing four quarters.

Despite global supply concatenation disruptions, KVH Industries is driving growth and margin expansion through new product introduction and subscriber migration to Loftier-Throughput Satellites. The visitor aims to brand decisive inroads into the however-nascent democratic transportation markets with a potent balance sheet and nix debt. If KVH Industries manages to finer mitigate supply chain woes, in that location could be room for cash menstruum expansion.

armstrongpludenis.blogspot.com

Source: https://finance.yahoo.com/news/verizon-vz-power-ev-fleet-134301195.html

0 Response to "Please Try Again or Contact Us to Complete Your Order Verizon"

Post a Comment